|

Amsterdam, Netherlands - 13 June 2024 - Venturelytic, Europe's leading investor data platform built on the Salesforce platform, is proud to announce the launch of its latest integration with Crunchbase. This new functionality allows Venturelytic users to seamlessly push company details from their Crunchbase lists directly into Venturelytic, significantly reducing manual data entry and enhancing the efficiency and targeting of their dealflow process.

Revolutionizing Deal Sourcing The integration with Crunchbase enables users to quickly create lists of potential add-on targets for platform companies or populate their deal funnel with highly targeted leads. By allowing users to filter companies by size (e.g., 10+ FTE) and specific domains (e.g., healthcare), this integration empowers VC and PE firms to adopt a more focused and effective approach to deal sourcing. “We are very happy to leverage this powerful functionality for our users,” said Mathijs Heutinck, CEO of Venturelytic. “Integrating Crunchbase with Venturelytic means our clients can now use high-quality data directly within their existing workflows, saving time and improving their strategic focus. This is a game-changer for firms looking to optimize their deal sourcing processes.” Other Data Connections and Best Practices In addition to the Crunchbase integration, Venturelytic has recently implemented several other data connections, enhancing its platform's capabilities and offering users even more robust tools for investment management. These new integrations facilitate data exchange with other international and local data providers. “At Venturelytic, our goal is to provide investors with the best tools and data to maximize their returns,” added Mathijs. “With our expanded data connections, we can now share a wealth of best practices with funds interested in improving their dealflow processes and outcomes.” Join the Venturelytic Community Venturelytic invites all VC and PE firms to explore the benefits of its new Crunchbase integration and other data connections. For firms not yet using Crunchbase or Venturelytic, the company offers expert guidance on best practices and alternative solutions tailored to their unique needs. For more information, please visit www.venturelytic.com or contact the team on LinkedIn. About Venturelytic Venturelytic is an innovative investor data platform designed to streamline dealflow and monitoring processes for venture capital and private equity firms. Built as a managed package on the Salesforce platform, Venturelytic offers powerful tools for data integration, analytics, and insights, empowering investors to make more informed decisions and create greater value. End of Release At moments, when we come out of busy periods of meetings and our day-to-day bubble full of to-dos, questions come up that unintentionally connect multiple experiences. They mostly start with a single observation, followed by similar ones in the period after. Sometimes these patterns aren’t new or remarkable at all, and sometimes they are, but they always leave me with a question. These questions often stick with us for a longer time before I almost always eventually ignore them or put them in a freezer. Now, we've decided to put a little more thought into it to trigger others to also think about it. One of these questions is: why do most VC and PE investors have no dedicated IT role or resources?

REASONS WHY This question came up after taking a look inside more than 25 VC and PE funds in the last year, while on the other hand, building up internal IT capabilities at Venturelytic and seeing our partners work on improving IT processes at lots of portfolio companies of these funds. While these portfolio companies have dedicated IT professionals or departments that streamline their internal processes, their investors often don’t. After giving it a bit more thought, we came up with the reasons why this is the current status quo and why this perhaps should change in the future. Download the full article here. Read our insights on the evolution of impact investing in our latest whitepaper that can be found here.

Last week, our team at Venturelytic attended the Private Equity Summit hosted by M&A Community Netherlands. Get an impression of the event here: https://mena.nl/artikel/private-summit-2022-trends-en-ontwikkelingen

Yesterday, we were invited to share our experiences around maintaining relationships between founders and investors in the Entrepreneurial Realities podcast of the TUM Venture Lab, hosted by Antoine Leboyer.

The episode covers:

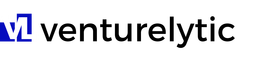

Check it out the episode on Spotify. Optimize your Deal Flow Process Deal flow is the lifeline of every investor. Having great deal flow (meaning: high quality and, ideally, in high quantities) determines the success of a venture capitalist (VC) to a large extent. However, investment professionals experience that generating and managing deal flow can be a time consuming and intensive process that demands efficiency. The way many teams currently organize their deal flow process, however, lacks the structure and effectiveness needed to thrive in an increasingly crowded industry. Simply put, deal flow refers to the rate at which your company receives new investment opportunities. According to research by Teten Advisors, the average investor in private companies evaluates over 80 opportunities to make a single investment. The same study also found that closing a single deal requires an average of 3.1 full-time investment team members - and 20 meetings with management. Needless to say, it's virtually impossible for you and your colleagues to manage all these potential deals from memory. Consequently, this means dealflow needs to be documented. That documentation is often stored across different tools and members of your team. This is largely due to the fact that many investors have not moved beyond generalist tools like Microsoft Excel and Outlook to keep track of their deal opportunities. Do More in Less Time in Growing Investment Teams Multiple individuals and teams throughout your organization likely play a role in securing an investment. When holding team meetings to evaluate potential investments you want to have a fruitful discussion, point each other at important deal elements and provide suggestions for next steps. All in a time-efficient manner. To achieve this, you need your whole team to be on the same page, meaning that everyone should be up to speed on who did what and when, where the deal is headed and what the next steps are. This becomes a real challenge when critical information is scattered across emails, spreadsheets, and numerous file storage apps. With only so many hours in a day, it can be a tedious task to find and bundle relevant information when needed. On top of that, these methods make it all too easy for details to get lost or forgotten, or for a meeting or phone conversation not to be followed up on as promised. The lack of a system for recording and managing interactions with a vast pool of potential target companies puts an additional administrative burden on the team who spend too much time and effort on gathering latest updates and information, more often than not resulting in unnecessary delays in a deal process. The lack of one source of truth in the dealflow phase often slowly decreases the quality of the decision making process, without the team noticing. Most of you will probably recognize these challenges. Download our whitepaper below to learn about the four tips we've bundled to optimize your deal flow processes. We provide you with weekly information on best practices in portfolio management. For anyone that wants to stay informed about the latest investment trends and efficiency hacks to create more impact. Sign-up below. From March on this year, we have an internship position available for students with a marketing and sales background. Applying is possible until February the 15th. Check out the position here.

Before the year end, Venturelytic was featured in the Dutch leading mergers and acquisitions platform MenA.nl.

The full article can be found here: https://mena.nl/artikel/datagedreven-investeren-makkelijk-gemaakt We are proud to be featured on the 730. podcast, in which tech founders are invited to share their experiences. You can listen the episode back on Spotify.

Yesterday, we were featured on tech new medium Silicon Canals.

Find a link to the article here: https://siliconcanals.com/news/venturelytic-dutch-saas-startup/ Rotterdam, Tuesday 22nd September 2020

With interest rates at historically low levels, the private capital markets saw a increasing influx of new capital and entrants into the market over the past years. As an industry that operates at the forefront of innovation, its leaders increasingly saw the necessity to adopt software solutions that provided them with a competitive edge. Dutch-based SaaS company Venturelytic provides these venture capital and private equity investors with a deal collaboration platform that keeps track of all relevant data during the dealflow and portfolio monitoring phase. Over the course of the last years, more and more investors experimented with the use of software. “Most of them quickly noticed, however, that the tools available in the market were often generic sales tools and didn’t fit extremely well with their practices, or basically were complex legacy solutions that couldn’t meet the user experience investors were used to as consumers“ says Venturelytic’s CEO and co-founder Mathijs Heutinck. Being an investor himself, Heutinck saw that he and lots of other colleague investment managers were heavily in need of a tool that could take over their time-consuming repetitive reporting tasks, allowing them to focus on creating value to their portfolio companies. Venturelytic released its beta-version approximately a year ago with a group of Dutch investors. “A year and a group of satisfied users further, Venturelytic goes live for the rest of the European investment ecosystem” says Heutinck. “We see a clear trend of investors becoming more data-driven and Venturelytic provides a secure foundation to further build upon. The current Corona crisis shows the importance of a closely monitored portfolio even more. Entrepreneurs love to work with actively operating and informed investors. Let’s hope a second Corona wave won’t hit us, so investors can go back to what they’re good at; create value”. Today marks an important step in our journey towards becoming the leading deal collaboration and portfolio monitoring tool for venture capital and private equity investors in the Netherlands and Europe. We successfully released a new and improved version of our investment suite on the world´s largest B2B Marketplace, the Salesforce AppExchange.

Huge thanks to Sergio Mac Intosh, Christa Koppijn & Rob Tuinte for making this happen. Check out our new app on https://lnkd.in/dwaecbM #investmentmanagement #portfoliomonitoring #venturecapital #privateequity During the Salesforce Accelerate EMEA Finserv program, Venturelytic was invited to the Salesforce for Startups podcast, with your host Mike Kreaden. We were more than happy to tell the world about our solution for private equity and venture capital investors.

You can listen the episode back on Soundcloud: https://soundcloud.com/salesforceforstartups/salesforce-accelerate-spotlight-venturelytic Tonight, Venturelytic attended the B2B SaaS Summit organized by our partner Salesforce. Great to see top-notch seed investors talk about innovation in investing, and happy to share our deal collaboration platform with industry leaders.

Last night was special for Venturelytic. In a finale, with 13 innovating Financial Services companies from EMEA, Venturelytic was invited to present its investor solution on stage at Salesforce European headquarters in London.

The evening marked the finale of a four-month virtual program by Salesforce Accelerate designed to provide insights and support participants to best align with Salesforce and accelerate their time-to-market with AppExchange. In front of an audience with experienced SaaS entrepreneurs, though leaders and investors, Venturelytic announced its go-live on the Salesforce Appexchange. We thank our partner Salesforce for the support and are looking forward to collaborating in the future. For more information, visit: https://medium.com/inside-the-salesforce-ecosystem/congratulations-to-the-emea-finserv-salesforce-accelerate-graduates-2e258973936b. This week, Dutch online technology news platform Emerce.nl featured Venturelytic with the announcement that the Dutch startup was selected to participate in the reknown Salesforce Accelerate Program.

The article can be found here: https://www.emerce.nl/wire/nederlandse-startup-venturelytic-geselecteerd-salesforce-accelerateprogramma We are proud to announce that Venturelytic has been selected by Salesforce to join the Salesforce Accelerate program for EMEA Fintech companies.

More information on the announcement and the goal of the program can be found here. Curious about the benefits for Venturelytic? Contact us at [email protected] and we'll show you. With the global financial crisis belonging to the past, the majority of European investors breathed a sigh of relief to be able to resume their ordinary investment processes. A few years ago, however, a small group of these investors predicted their ordinary investment strategies would no longer provide them a competitive advantage in the fast changing investment landscape. They decided to adopt disruptive strategies to boost their returns.

One of the most interesting articles of the last few years that appeared on the web on this shift in investment focus was posted on Startup Grind by Stefano Bernardi of Mission and Market. Where most of the investors just hired new analysts to cold-call a dozen of new targets every week, these disrupting investment firms adopted a data-centric approach, more or less creating an inbound marketing system for the investment business. Interested in the results? Read the full article here and contact us to discuss latest trends in VC and PE. |

Customer success is our #1 priority |

Product |

Resources |

Company |